CAPED CREDIT UNION CASE STUDY

Hybrid service model serves up the future of CX.

The Story

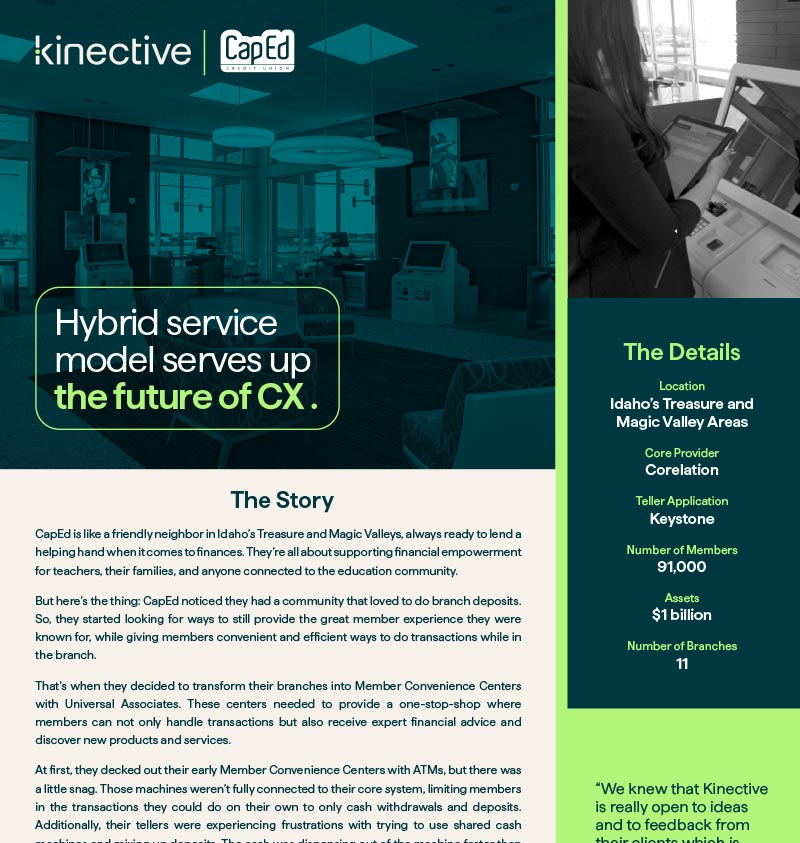

CapEd is like a friendly neighbor in Idaho’s Treasure and Magic Valleys, always ready to lend a helping hand when it comes to finances. They’re all about supporting financial empowerment for teachers, their families, and anyone connected to the education community.

But here’s the thing: CapEd noticed they had a community that loved to do branch deposits. So, they started looking for ways to still provide the great member experience they were known for, while giving members convenient and efficient ways to do transactions while in the branch.

That’s when they decided to transform their branches into Member Convenience Centers with Universal Associates. These centers needed to provide a one-stop-shop where members can not only handle transactions but also receive expert financial advice and discover new products and services.

At first, they decked out their early Member Convenience Centers with ATMs, but there was a little snag. Those machines weren’t fully connected to their core system, limiting members in the transactions they could do on their own to only cash withdrawals and deposits. Additionally, their tellers were experiencing frustrations with trying to use shared cash machines and mixing up deposits. The cash was dispensing out of the machine faster than the teller could get to it, putting deposits on top of deposits and causing potential mix-ups.

CapEd knew they needed innovative technology that would make their new centers shine while still being approachable. But they also knew the only path to success was through integrated solutions. Luckily, CapEd had a great relationship with the integration experts, Kinective. They were looking to bring a smooth member experience to life through integrated self-service kiosks, and untethered universal associates who weren’t restricted to workstations. Kinective had just the answer they were looking for.

1000s

of transactions migrated to self-service

1-to-many

associate to hardware ratio

1000s

of financially empowered members

The hybrid model

CapEd is all about supporting financial empowerment for their members, while keeping up with the latest in banking technology. They’ve been dedicated to providing top-notch banking experiences for over 80 years. And with the help of Kinective’s full suite of solutions, they’re not just looking into the future but ready to soar through another 80 years and beyond.

The Results

CapEd had a long-standing relationship with Kinective, having used their cash recycler integration and analytics platform to optimize their branch transactions for several years. And now they were ready to take it a step further by rolling out a hybrid service model that incorporated full, assisted, and self-service choices for members to transact.

Kinective’s GENIX and NOMADIX solutions were exactly what CapEd was missing to make their vision operate. With GENIX, a direct self-service kiosks integration to Corelation, members could do nearly any transaction on their own, including deposits/withdrawals, cashier’s checks, bill and loan payments, and more.

And if a member needs help, associates are armed with a portable Microsoft Surface Pro device, powered by NOMADIX, so they can step in to assist or provide full service.

Queuing up cash transactions also has become a breeze, and they can now be completed on the self-service kiosk via RTA. This enables CapEd to run on a leaner staffing model, which helps FTE spend, and allows the sharing of hardware.

Instead of a one-to-one or two-to-one ratio that normal cash machines have, these machines could serve many associates to one machine, thus serving up some significant hardware spend. Plus, the associates can keep a watchful eye on the cash machines and their inventory using Kinective’s award-winning iQ feature on their tablet device.

It’s all about making things easier for their members. Now, members can still pop in and have a friendly chat with their banker if they have complicated questions, but they also can save time and do more complex transactions on their own. That allowed associates have more time to share their expertise and advise on the best products and services. It’s like having your own financial superhero!

CapEd is all about supporting financial empowerment for their members, while keeping up with the latest in banking technology. They’ve been dedicated to providing top-notch banking experiences for over 80 years. And with the help of Kinective’s full suite of solutions, they’re not just looking into the future but ready to soar through another 80 years and beyond.

Products Used

Branch Workflow

Data & Analytics

Download the CapEd case study.