HUGHES FCU CASE STUDY

From weeks to minutes: digitized loan process shortens lending cycle and boosts volume by 27%.

The Story

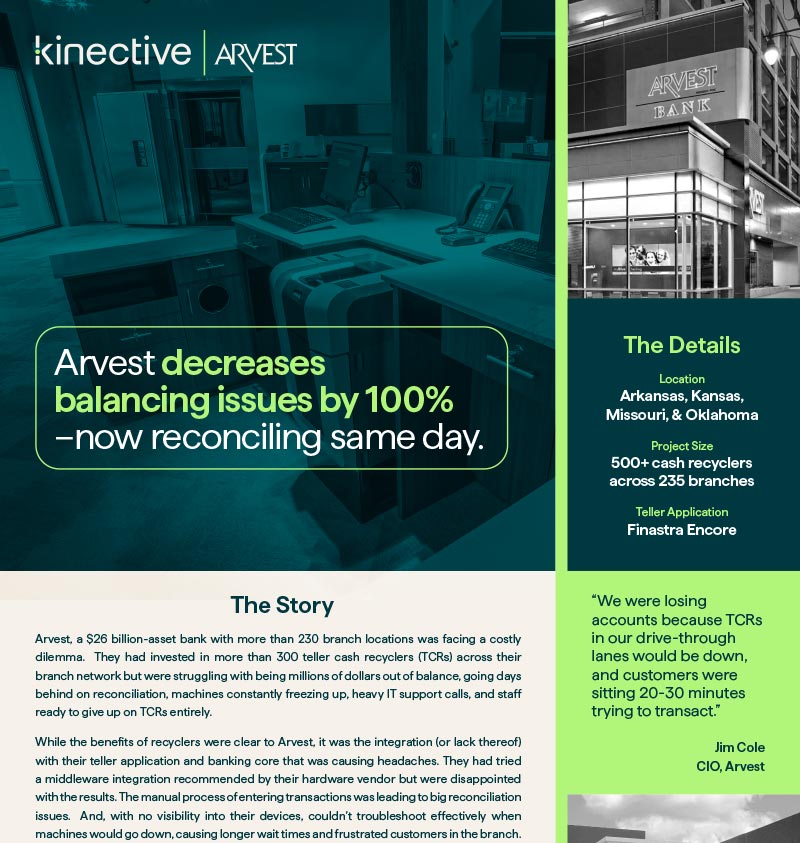

Hughes Federal Credit Union prides itself in connecting the right products and services to members. And when their manual lending process impacted their ability to quickly fund loans—they knew it was time for a change. Their process of sending all back office-originated loans (online and outbound call centers) to branches for funding meant high document shipping costs, multiple manual steps, and long closing times. Even worse, their multiple-week funding timeline was causing lost opportunities.

$107K

saved per year

98%

reduced loan processing time

27%

increase in lending volume

The Results

Hughes Federal Credit Union’s partnership with Kinective centered around digitizing loan processes through e-signatures and document automation to eliminate trips to a branch for completion. Even more so, they wanted a partner that understood the nuances of banking to ensure the process fit their needs and went smoothly.

Since implementing Kinective’s IMMeSign and IMMeSign Plus, Hughes FCU has achieved remarkable results, enhancing both back-end efficiencies and member satisfaction. They saw a significant reduction in loan processing time, with the average processing time going from several weeks to just 120 minutes.

Substantial cost savings have also been achieved by eliminating the need for express mail, resulting in a $0 cost per loan versus the usual $40. Additionally, indirect lending has increased 27% attributed to the convenience of remote electronic signatures. The credit union is now boasting an impressive loan closure rate, with 90% of centralized lending credit cards and 50% of centralized lending non-credit card loans being funded through remote digital signatures.

Hughes FCU has successfully moved away from a paper-based manual process to a fully electronic environment,” said John Levy, Kinective’s, EVP of Partnerships. “In a relatively short time, the credit union completely transformed how employees assemble and deliver loan packages faster than ever, without additional resources, plus members gain the convenience of not needing to devote time in-branch awaiting approval and returning to sign documents. These factors together have a major impact on the credit union’s bottom line, enabling it to operate more efficiently while providing members with a positive, easy to use experience.”

These changes have translated into estimated annual savings of nearly $107,000, while also promoting eco-friendliness by eliminating the need for paper loan packages. Hughes FCU’s early success with eSignatures has led to further expansion into member services, operations, call center, and collections solutions. Even better, the credit union is empowering front office branch staff to expedite approved loan funding, eliminating the need for members to schedule return appointments to the branch.

Products Used

Branch Workflow

Download the Hughes FCU case study.

Hughes Federal Credit Union’s partnership with Kinective centered around digitizing loan processes through e-signatures and document automation to eliminate trips to a branch for completion. Even more so, they wanted a partner that understood the nuances of banking to ensure the process fit their needs and went smoothly.