Here are 5 reasons you need to make micro branches part of your branch network strategy to get ahead:

1. Branches aren’t going away

Even as traffic continues to decline and mobile banking rises, branches are still an important convenience for clients. A recent study of 1,000 consumers found that despite the restrictions imposed by the pandemic, almost seven in ten Americans (69%) had visited a bank branch in the past 12 months.

Looking at what the big banks are doing, they also agree that branches are still relevant. At the recent Goldman Sachs U.S. Financial Services Virtual Conference, U.S. Bank CEO Andy Cecere stated, “Branches are still important, but they’re going to be less of a place where people go for transactions and more for advice and consultation. Therefore they don’t need to be as large.”

Chase Bank also continues its $20 billion investment of adding 400 new branches over the next few years. And not surprisingly, Chase is still finding that 60% to 70% of new accounts are opened in branches.

2. Micro branches reduce operating costs

Unless you’re a digital-first institution, your branch and ATM networks are probably your largest expenses next to staffing. Unused space is costly, so if you don’t have lines of people waiting in your branches, it’s probably wasted space.

Instead, a micro branch can provide an average operating cost reduction of 61%. Branches that are 1500 sf or greater have an average operating cost of $550k versus a much lower spend of only $210k for a micro branch. We all know bankers are numbers people, and that doesn’t take a mathematician to see how these types of cost reductions can add up quickly.

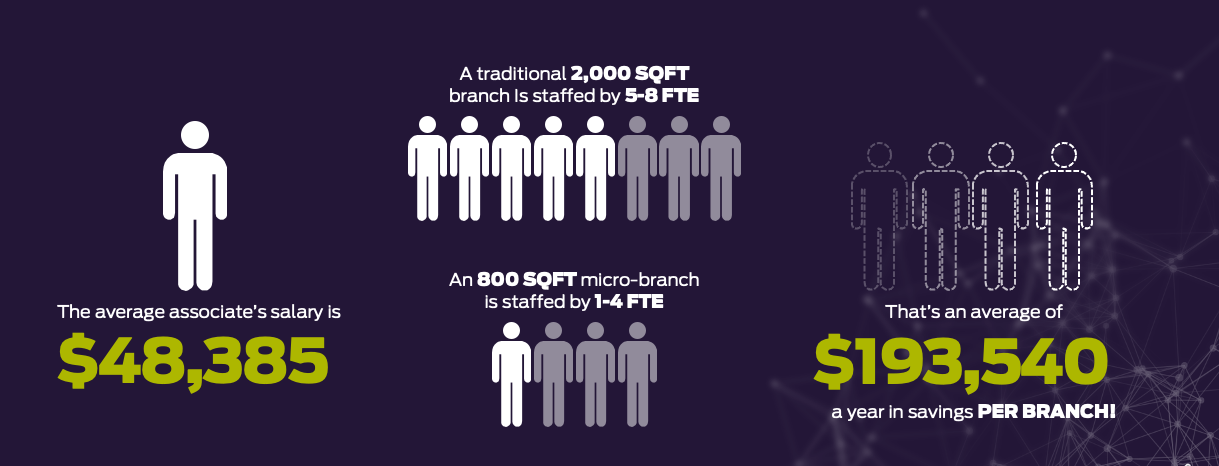

3. Micro branches require less manpower

With a smaller space also comes the need for less staff to run it. Where a typical branch is staffed anywhere from 5-8 FTE, a micro branch can be run by a mere 1-4 FTE. That’s an average annual reduction of $193,540.

For those credit unions ready to shift to a Universal Associate model, where a single staff member can handle every type of transaction, you can successfully operate the branch with only one person.

For those credit unions ready to shift to a Universal Associate model, where a single staff member can handle every type of transaction, you can successfully operate the branch with only one person.

BCU, a $4.5B Illinois-based credit union, has now rolled out 30 micro branches doing just that. Their micro branches range in size from 200 sq. ft. – 600 sq. ft. and are staffed by one “Branch Experience Manager”. This role has branch manager capabilities and the necessary decision-making authority to run the business. But the unique part is that they are also an individual contributor responsible for signing up new members and opening accounts. They really are the Universal Associate who is doing the lending, the relationship building, the transactions, account opening…really everything!

4. Micro branches can grow your network in a cost-efficient way

To improve your long-term financial health in retail financial services, you must have scale. The ability to reach and attract more clients is drastically improved by having a larger network. But you need to drive growth in a cost-effective way.

For example, credit unions are lagging behind banks regarding branch network size. According to recent FDIC and NCUA data, there is basically an equal number of credit unions and commercial banks in the U.S., but there are four times as many bank branches as credit union branches. The data shows that an average credit union has just five branches versus 20 for banks.

The inequality in branch network size may contribute to the average credit union branch’s deposit base being 28% smaller than the average retail bank branch’s deposit base. The average bank branch is $97 million dollars and the average credit union branch is $69 million (individual bank branch deposits were capped at $500 million to minimize the impact of corporate deposits.)

Micro branches are your answer to start changing your market penetration. Because of their reduced operating and staffing costs, you can now up your coverage at a fraction of the cost.

5. Micro branches allow you to be in more creative places with higher foot traffic

For many banks and credit unions, the goal of branches is to get closer to where clients live, work, and play. Of course, attractive real estate comes at a premium, So when your space needs aren’t quite as large, you open up many more opportunities. These locations enjoy more foot traffic when placed inside or next to other businesses.

BCU has taken its micro branch strategy and used it to place branches inside the corporate offices of its workplace banking partners.

As Dan Parsons, Vice President of Branch Operations at BCU, explains, “Personally, I would much rather have a 400 sf location in a highly trafficked area within our company partner sites versus 2000 sf in an adjacent building that no one really utilizes. Employees now see the credit union regularly and our ability to interact with them on a consistent basis is critical to our growth strategy.”

For a deeper dive into micro branches and BCU’s successful strategy, take a look at this webinar on microbranches.

.jpg)

Making these tight spaces work takes an experienced partner

Figuring out how to best maximize small spaces to provide the right level of service, privacy, traffic flow, and needs of the clients can often be tricky. There are a lot of best practices and technology that need to be considered. And, with limited space, there are often tradeoffs for what you can and can’t have in the branch.

How will you handle cash? How will you offer privacy?

We find the strategy should start with the endpoint in mind, then you can start to back your way into the “must haves” for making the branch experience work.