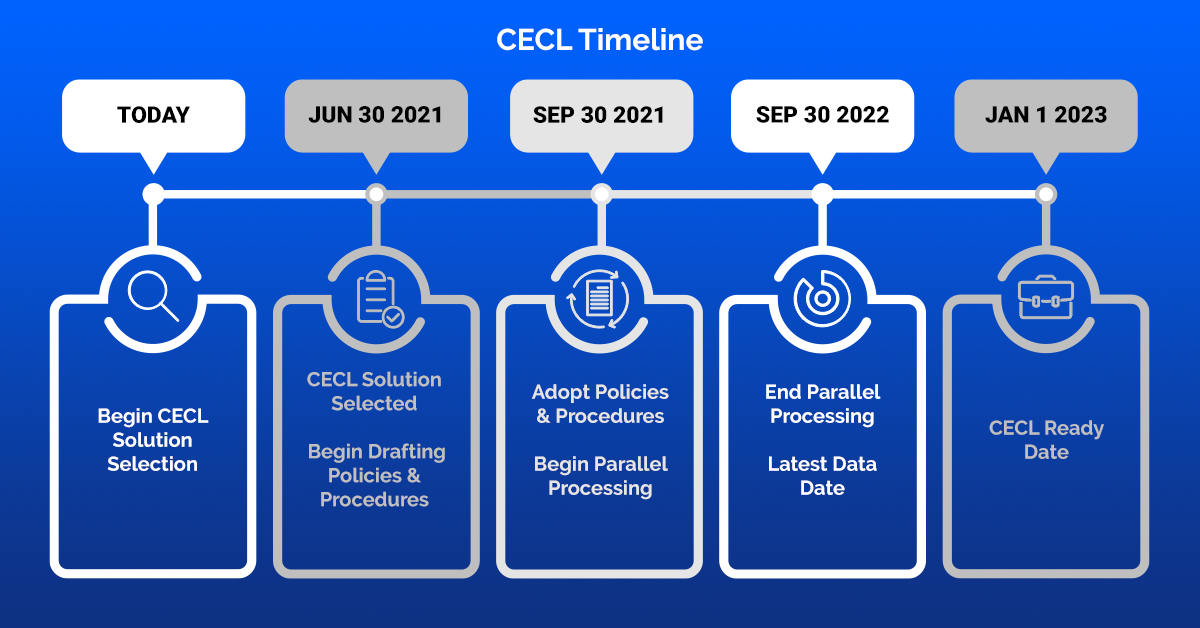

The joint agencies released a final policy statement on CECL (FIL-54-2020) May 8. FASB does not seem to want to back down and, whether the JA’s agree or not, it is happening. Mark your calendars: all remaining financial institutions will adopt CECL, and they will reserve day-one exposure on January 1, 2023. But why do something today that you can put off for two and a half more years? Let’s work backwards through that.

I suggested marking your calendars for January 2023, but read on and you will find a few more dates to target along with steps and activities associated with implementing CECL.

January 1, 2023 – CECL Ready Date

CECL becomes effective this date for most institutions (or the start of the next fiscal year after 12/15/2022.) Applying CECL on that date means that you must reserve “Day-One exposure” on that day.

CECL requires you to reserve the expected lifetime loss on your new loans on the origination date of that loan. It’s a new calculation – how are you going to make new loans without a calculated and documented CECL reserve estimate? You can’t wait until December 2022 to decide what that calculation will be.

September 30, 2022 – End Parallel Processing; Latest Data Date

To have an operational CECL reserve calculation you can’t wait for December 31, 2022 data. Year-end presents special challenges anyway. Call reports and 5300s aren’t even due until late January. Assuming you had the data, you’d need time to process and document it. So there’s no way you can wait for December 31, 2022 year end data. If you’re using an aggregate method (using call or 5300 data), you must start, at the latest, with September 30, 2022 quarter-end data.

September 30, 2021 – Adopt Policies & Procedures; Begin Parallel Processing

To safely make the change from the incurred method to the expected loss method (CECL) you should run parallel for at least a full year. That may sound like a long time but it’s only 4 quarter-end data dates for aggregate model users. On the other hand, CECL is the biggest accounting change to hit financial institutions in decades. It’s a generational shift and a {{cta(‘9999f406-8f5a-4fe1-8691-1d1c9c22c8ce’,’justifycenter’)}}complete transformation from today’s incurred (current loss) method to tomorrow’s CECL (current risk) method.

The shift to lifetime loss reserves (and the expected increases in reserves from going to a multi-year perspective) plus the resultant impact on your capital levels alone should be enough to demand a thorough review before going “live”. But there is much more to be done. You need the time running parallel to fine-tune your model, adjust loan pricing as needed (Do you understand how CECL is likely to influence your loan pricing?), and to familiarize everyone in the institution (as well as your various State and Federal examiners) with all of your changes. So realistically, you need to start CECL by 9/30/21 to safely and practically meet that Jan 1, 2023 start date.

June 30, 2021 – CECL Solution Selected; Begin Drafting Policies & Procedures

To begin parallel processing September 30, 2021, your Board-approved policies and procedures must be ready to go leading up to that date. There will still be tweaks to your policies and procedures while running parallel, and for the foreseeable future. But to have the bulk of the Board’s drafting, reviewing, and approving of CECL policies complete by 9/30/21 you’re missing one big piece of the puzzle. You can’t do this if you haven’t determined exactly how you are going to implement CECL. This

means your CECL solution selection must happen by or before June 30, 2021.

Today – Begin CECL Solution Selection

To select your CECL solution by June 30, 2021 you must get started now. Every bank and credit union needs to start now with internal education, quantifying and estimating your likely CECL financial impact, and understanding the demands on your institution’s resources, time and expertise. Few financial institutions have excess time and resources, and almost none have the required expertise inhouse. NXTsoft can help you connect the dots, and avoid the pitfalls, in prepping for CECL.

Don’t let the cost and complexity of CECL paralyze you. We understand your limited time and resources. We also understand that you don’t want to allocate funds before you need to. NXTsoft has a plan to help you start filling in your CECL gaps. Best of all, we have analysts to walk you, your top management team, and your Board of Directors through these massive changes.

Final Thoughts

Think about 10,000 financial institutions waiting to the last minute to implement CECL. Will they all be able to get the help they need, or will they compete for time and attention? It is now time for every bank and credit union to get started seriously working through the CECL timeline. Your examiners will be looking for your progress this year. We can assist you in getting those uncomfortable questions answered a little bit more easily. And we can help you navigate the twists and turns on your CECL roadmap. Just let us know you’re interested and we’ll do all the heavy lifting.