The First-ever Kinective User Conference

Kinective’s inaugural user conference, Kinections25, brings together FIs for face time with peers, experts, and personalized guidance to grow and optimize your institution.

Dive deep into peer insights on what’s driving results.

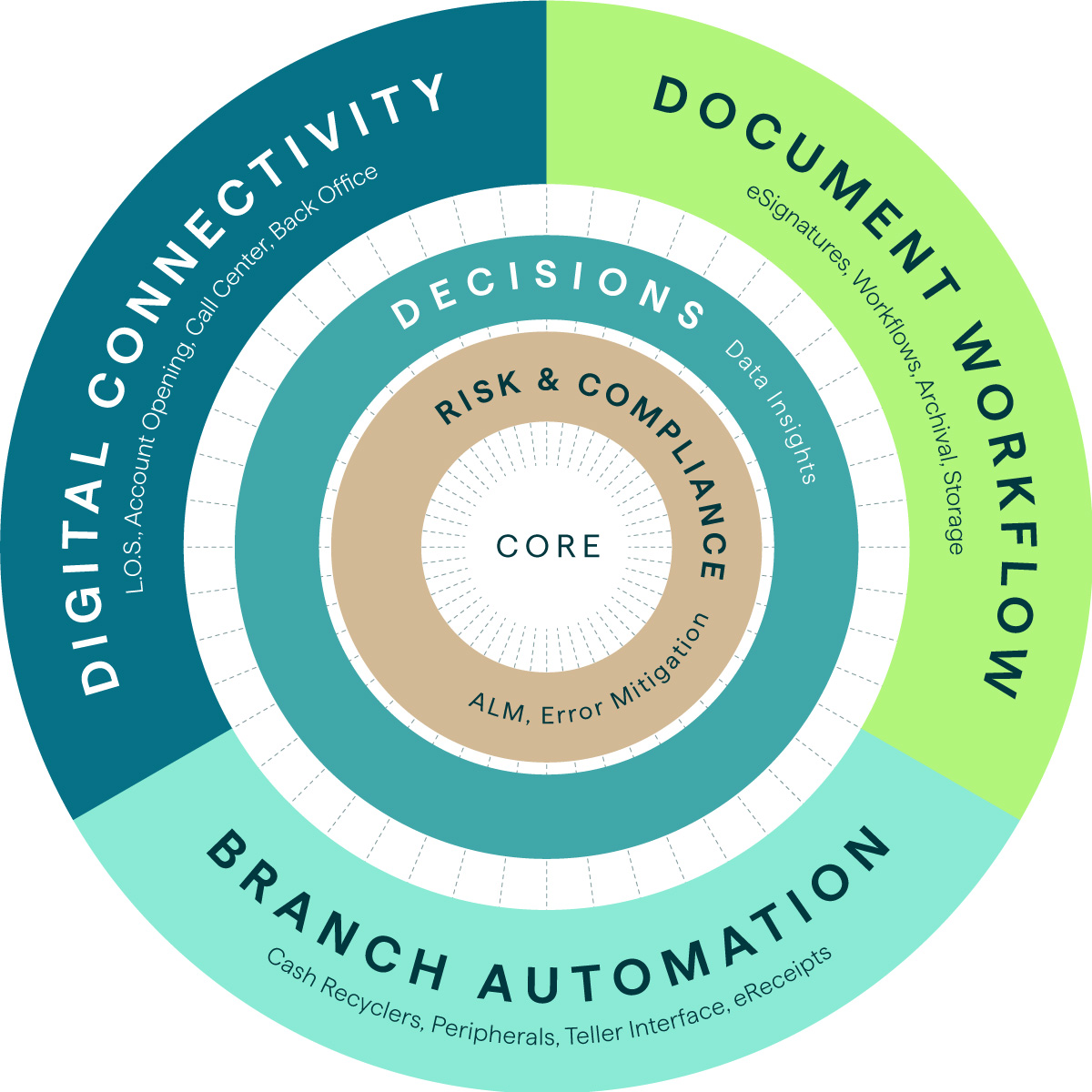

Get hands-on with our full suite of innovative banking products and learn which might help propel your success.

Space is limited – claim your spot now at this can’t-miss event.