Artificial Intelligence (AI) is established and augmenting many businesses, including financial services. Banks, credit unions, CDFIs, and other lenders are already using AI for a variety of front, middle, and back-office processes including self-service banking, marketing automation, document analysis, fraud detection, compliance, collections, and credit underwriting, to name a few. AI is a powerful technology that can process vast amounts of data, automatically learning and improving from data without being explicitly programmed. This has tremendous applications for identity management, fraud detection, and credit risk where outcomes from previous decisions can be used to create accurate decision models, then ongoing outcomes are fed back into the models to continuously adjust and improve performance. The feedback can be automated and continuous with online-learning or managed and incremental with off-line or governed learning.

Analysts estimate banks will save $1 Trillion over the next 10 years leveraging AI. That said, throughout 2020 and into 2021, banks have seen deposits grow and loan volume decrease because of the pandemic. Through Q2 2020 the loan to deposit ratio decreased from 71.9% to 68% (Source: FDIC Quarterly Report). Mortgage refinancing aside, the drop could be demand related as borrowers look to PPP loans and other government programs. Or, it could be on the supply side as lenders may be concerned about the creditworthiness of borrowers in the face of increasing delinquencies. If the drop is supply side, borrowers may turn to non-bank lenders who have embraced newer, automated underwriting technologies to better evaluate and service their borrowers.

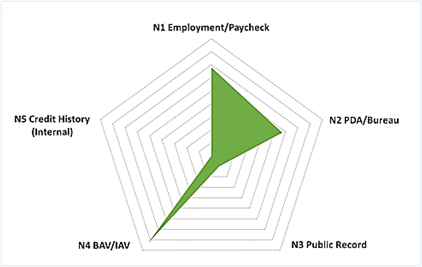

AI-driven credit underwriting presents an opportunity for banks to increase loan volume while effectively managing risk and ensuring compliance. Credit bureau scores have historically been the primary tool used to underwrite individual borrowers. Due to the pandemic, the CARES Act ensures that consumers impacted by Covid-19 do not have their scores negatively impacted if they receive loan accommodations, effectively masking some borrowers’ financial difficulties. In addition to that, there are an estimated 26 million borrowers who are credit invisible (Source: CFPB) and another 20 million with thin or poor credit scores. Many banks and non-bank lenders are already using alternate or alternative data in addition to credit bureau data to better understand borrowers. Alternate Data is being used to develop a current financial profile of a potential borrower to determine their identity, and their ability and willingness to pay. Using AI, this alternate data can benefit all steps of the lending process from eKYC, fraud prevention, lead purchase decisions, credit underwriting, monitoring, and collections.

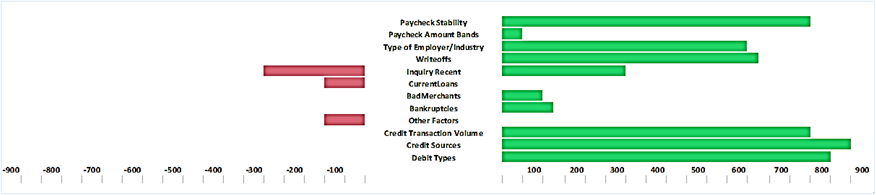

Alternate data is readily available from various services including data aggregators, public records, bill payments, payment platforms, social media, and other digital footprints. Some of these sources require explicit customer permission to access the data, while others require no explicit permission. An example of customer permissioned Alternate Data is bank account transaction data. In the loan origination process the lender may require 3-12 months of bank account transaction data (income and expenses) to build a financial profile. During the online application process, the borrower is prompted to log into their bank account where a secure token is returned to the lender giving them temporary, read-only access to the borrower’s bank account transactions. The financial profile created may include a monthly cash flow analysis, spending patterns, loan obligations, and income regularity. These are fed into an AI model that evaluates the information producing financial metrics or scores that can be used in the underwriting process.

permissioned Alternate Data is bank account transaction data. In the loan origination process the lender may require 3-12 months of bank account transaction data (income and expenses) to build a financial profile. During the online application process, the borrower is prompted to log into their bank account where a secure token is returned to the lender giving them temporary, read-only access to the borrower’s bank account transactions. The financial profile created may include a monthly cash flow analysis, spending patterns, loan obligations, and income regularity. These are fed into an AI model that evaluates the information producing financial metrics or scores that can be used in the underwriting process.

While there are many benefits of using AI, there is also some apprehension concerning AI being a black-box and not fitting it into a model governance framework. Fortunately, AI model transparency techniques are steadily advancing, providing insight into how models make decisions. These transparency techniques are also used at the individual loan level; for model validation monitoring and outcomes analysis, to populate Adverse Action letters, marketing segmentation, or to drive hyper-personalized and instant communications.

In the area of financial inclusion, the use of Alternate Data to underwrite loans for minorities and women was shown to have such a positive effect in increased approval rates, lower interest rates, and higher loan amounts, that the Consumer Finance Protection Bureau (https://www.consumerfinance.gov/) issued its first No-Action Letter (NAL) to non-bank lender Upstart after investigating their use of alternate data to underwrite borrowers. The CFPB has also recently issued policies to facilitate compliance and promote innovation.

In summary, AI is a powerful technology quickly gaining momentum in all areas of financial services. Its early adoption among non-traditional and new-age lenders has been a proving ground, demonstrating its applicability for credit underwriting. This has also made it accessible and affordable for banks of any size. The easiest way to take advantage of this technology is to partner with FinTechs who have researched and invested heavily in specific technologies in your area of interest. The time to value is typically short compared to building custom solutions in-house, the risks are lower because they have already done this for other institutions, and the experience and learning they bring along with them will quickly increase the knowledge of AI within the institution.